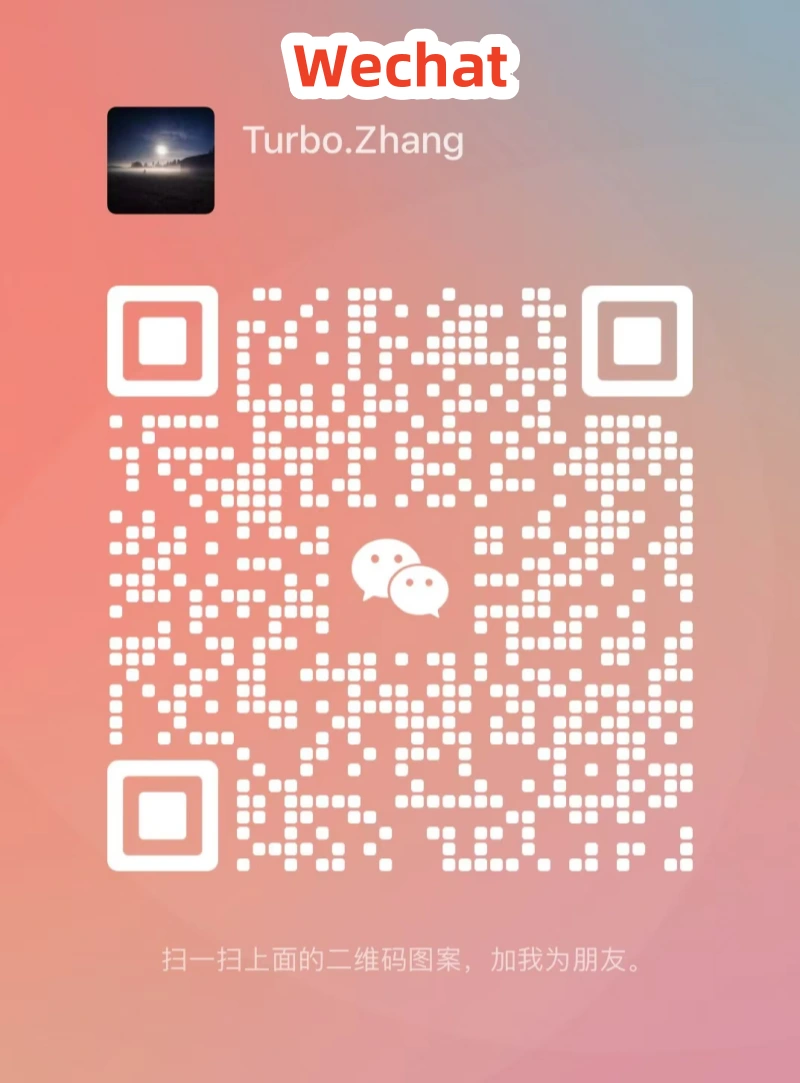

Scan the WeChat code to contact us

Mainly engaged in various brands of turbochargers.

The vehicle fleet in Italy is continuing to age. Data analyses indicate that by 2024, the average age of vehicles in circulation had reached 12 years and 10 months. Separate data show that by 2025, the average vehicle age had already surpassed 12 years, with Milan, having a relatively “younger” fleet, still averaging over 11 years. This phenomenon of vehicle aging is similarly notable across the European Union, where over 249 million cars are on the road.

This widespread aging of the vehicle population directly fuels a stable and sizable automotive aftermarket. According to industry association data, Italy’s automotive parts revenue has achieved four consecutive years of growth. The market’s growth is driven by the practical needs of vehicle owners: 94% of households own a car, and 69% of owners use their vehicles daily. Faced with high professional maintenance costs, owner behavior has shifted significantly.

Data reveals that 55% of owners postpone maintenance due to cost, and 46% perform at least one DIY repair annually. This trend has made online platforms a crucial channel for procuring auto parts, with related searches being highly active. Market feedback shows that body parts, automotive electronics, and turbocharger-related components are among the categories with the most significant sales growth in recent years.

It is important to note that the transition to electrification is a long-term variable affecting the global automotive aftermarket. The increasing adoption of battery electric vehicles (BEVs) is expected to gradually reduce demand for internal combustion engines and traditional intake systems, including turbochargers, presenting a structural challenge for the aftermarket.