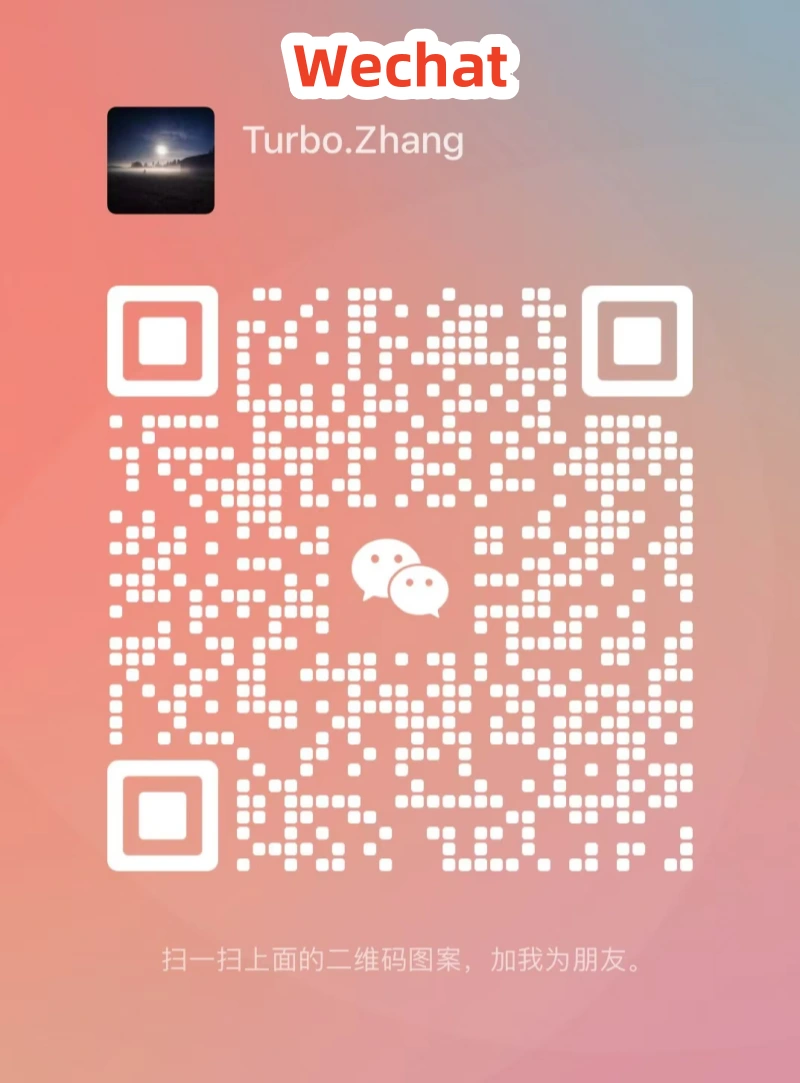

Scan the WeChat code to contact us

Mainly engaged in various brands of turbochargers.

In South Korea, a nation with over 26 million registered vehicles, the relationship with the automobile is evolving. As the average age of a car on its roads reaches seven years, a mature market is demonstrating a sustained demand for maintenance and performance upgrades. Simultaneously, a strong policy push towards hybrid electric vehicles is reshaping the technological demands of the aftermarket. At the intersection of these trends—ageing fleets and new powertrains—lies a growing and nuanced opportunity for turbochargers.

The story of the turbocharger in Korea is no longer just about performance. While their application in high-performance internal combustion engines remains significant, their role is expanding. The rise of hybrid electric vehicles has created a new chapter. For instance, the industry took note when BorgWarner secured a contract to supply 1.6-litre turbochargers for hybrid SUVs produced by a major Korean OEM, with plans for localised production by 2027. This move signals a clear trajectory: turbochargers are becoming a critical component in the bridge technology towards electrification, optimising the efficiency of the gasoline engine that complements the electric motor.

This evolution is supported by homegrown engineering. Hyundai Motor Group’s development of its CVVD (Continuously Variable Valve Duration) technology, which achieves a remarkable 43% thermal efficiency, is a testament to this. This innovation is designed to work synergistically with turbocharging, demonstrating how deeply integrated the technology is in the future roadmap of Korean automakers.

For those in the automotive trade, these technical shifts are reflected in the changing retail landscape. South Korea’s auto parts market, valued at over $10 billion, has undergone a digital transformation, with more than a third of all sales now occurring online. The platform Coupang has become a dominant force in this space, accounting for a significant portion of online auto part sales. Its logistics network has made it feasible for consumers and workshops to access a wide range of components with rapid delivery, changing expectations for parts availability.

For international manufacturers and suppliers, the trade environment has also become more favourable. The Regional Comprehensive Economic Partnership (RCEP) has ushered in a regime of gradually reducing tariffs on various auto parts, including some turbocharger systems, easing market entry and fostering more competitive pricing.

The Korean market today presents a dual opportunity for turbocharger specialists. There is a consistent aftermarket demand from an ageing vehicle population requiring reliable, direct-fit OEM replacements. Alongside this, there is a emerging, tech-driven demand for components that are compatible with the next generation of hybrid vehicles. Success in this market hinges on an understanding of these parallel dynamics—serving the needs of today’s internal combustion engines while preparing for the hybrid-centric future of South Korea’s automotive industry.